Do your models float?

The biggest advantage of discretionary management is the ability to put clients with the same risk profile and goals in the same professionally managed model portfolio. This is a major boon to advisers, as they are freed from the burden of researching, selecting and monitoring investments for each individual client. But platforms that call themselves discretionary are often simply advisory platforms that have been repurposed with discretionary features bolted on, with all the limitations this implies.

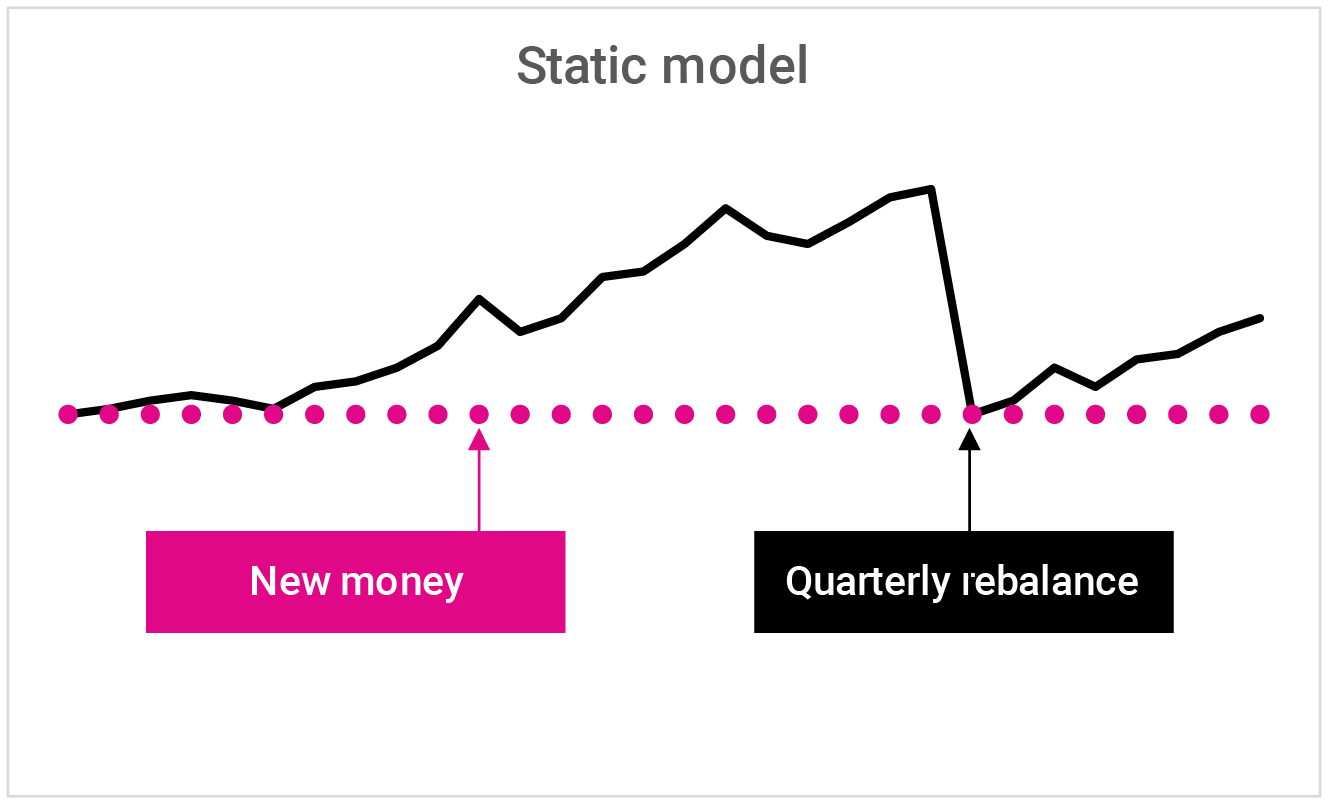

One key area where the limits of retrofitting are obvious is around asset allocation and rebalancing. Most discretionary platforms follow the advisory model of static asset allocation with periodic rebalancing to bring the investor back in line with the selected model, and many advisers don’t know there is a better way.

The discretionary platform should be relatively pain free for discretionary fund managers, whose only task is to set the weightings for portfolios. The problem isn’t with setting the weightings, but in what happens after. If the platform has static asset allocations then things can get out of hand very quickly.

Let’s take an example where an adviser puts a client into a model that has 50% in fund A and the other 50% in fund B. The client’s weightings start at 50/50, but a few weeks later, thanks to market movements, their portfolio may have moved to 55/45 (or even wider in a particularly volatile patch). Over time, the portfolio will drift further and further from its asset allocation and will need to be rebalanced (with all the commensurate trades and costs) to bring it back into alignment. Worse, the rebalance date is normally pre-determined and so trades may be placed on a sub-optimal time to trade.

It gets even more complicated when two portfolios are involved. If, for example, a husband and wife have the same risk parameters and portfolio, they could end up with different performance just because a transfer comes in a week later. This could make for some difficult conversations at review meetings. When this same format is applied across an entire client base, over the course of a month or quarter, every single client that goes in has a slightly different portfolio and therefore a different experience. During performance reviews it can sometimes be tricky to try to explain why actual performance is radically different from the performance of the model. Additionally, the extra charges necessitated by quarterly rebalances can have a dramatic drag on long-term portfolio performance.

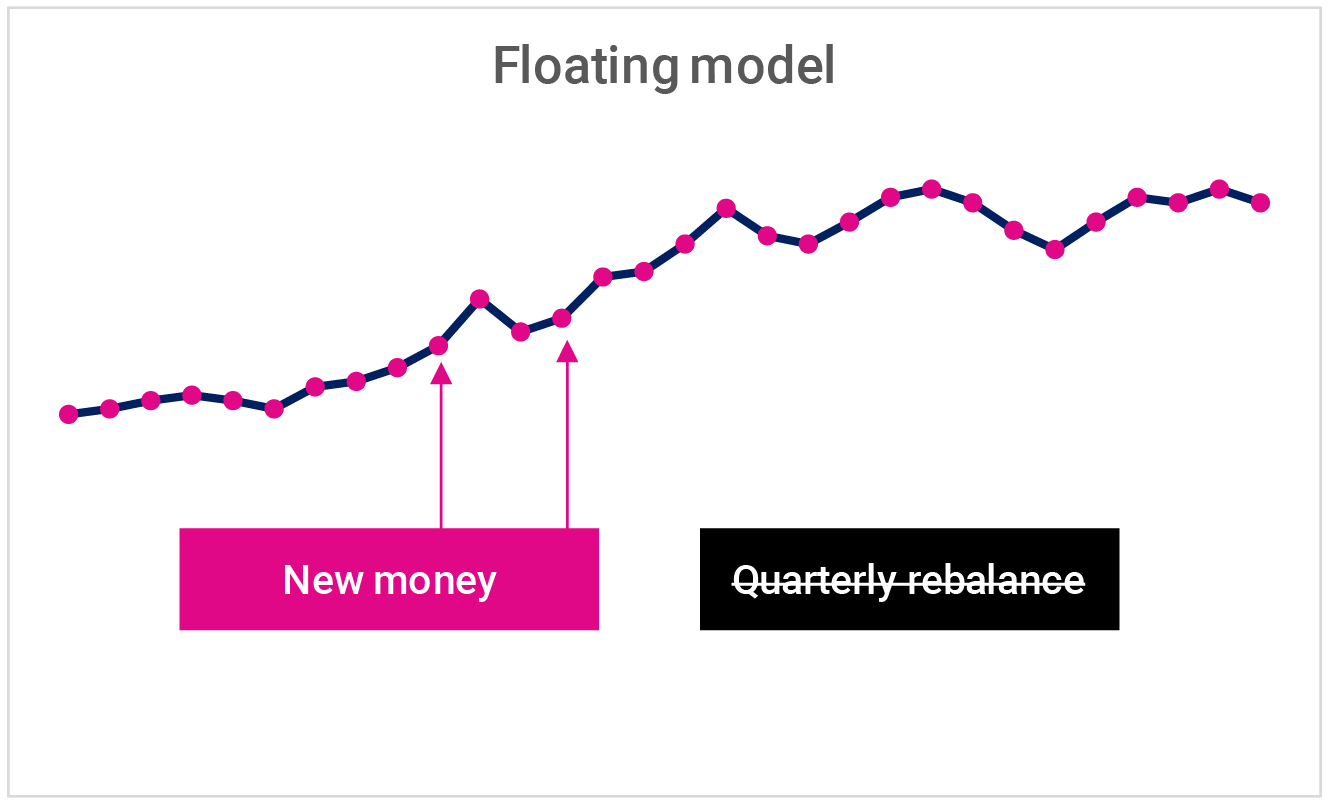

All of this complication and variation goes away with one simple bit of technology – floating models. Using the same example above, client A buys in at 50/50 and a few weeks later client B buys into the same model, but at the ‘drifted’ weight (of 55/45 using the example above). The model weights float daily just as it would in an open-ended fund, so all investors are always in line with the model, in line with each other and in line with the investment manager’s view. There is no unnecessary rebalancing and the investor is free to change strategies as and when appropriate. Every client receives the same weightings and therefore takes the same risk and experiences the same performance.

Of course, floating models are great for discretionary management, but are next to impossible to achieve on platforms that have been retrofitted from advisory. This could be a problem for advisers that have adopted a discretionary business model. One of the key elements of the FCA’s Thematic Review on assessing suitability (TR16/1) was the regulator’s fear that advisers were more inclined to retain an existing platform and “retrofit” due diligence to reflect that decision. “Many firms demonstrated inconsistent and insufficient research and due diligence in the selection of platforms. We believe this was caused in some cases by status quo bias and an ‘if it isn’t broke don’t fix it’ attitude.” *

When a client’s investment solution completely changes, as it would when moving from advisory to discretionary, then advisers should be carrying out an objective assessment of the most suitable platform to execute that new solution. One of the key questions should definitely be, “do your models float?”

*Source: TR16/1 Assessing suitability: Research and due diligence of products and services

Upgrade today!

Start the upgrade now. Ask our expert team about the ways

Morningstar Wealth Platform can transform your business.