A different approach to other platforms.

Whereas most are product-centric (e.g. start with your client’s SIPP and then ask what investments you want in it), we’re portfolio-centric, we start with the investments you’ve selected and then ask how you want to hold them. We know that most advisers prefer to create diversified multi-asset portfolios for their clients, so our portfolio structures are designed to cater for that. The result is a genuinely investment-led platform.

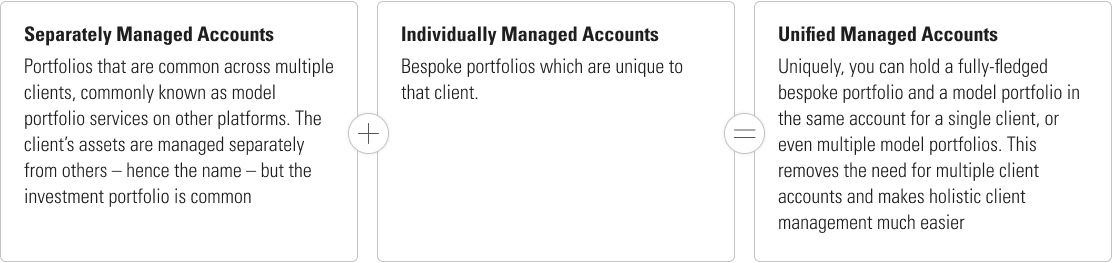

As a consequence, we have a couple of different terms for how things run. What you know as a model portfolio service, we call a Separately Managed Account. What you call a bespoke portfolio, we call an Individually Managed Account. If you want to hold each type of portfolio for a client simultaneously, we call that, surprise surprise, a Unified Managed Account, on account of the fact that it’s unified. You’ll get used to it quickly, and we’ll keep you straight while you do. Here’s how to remember it:

Managed Account automation

The industry benchmark for rebalancing, trading & corporate actions, our unique integrated Managed Account platform provides a high level of automation that increases accuracy, lowers costs and improves efficiency, saving time and money.

- A world class auto-rebalancing engine eliminates “drift” between investor and model and between investors who are attached to the same model portfolio. You no longer need to monitor for drift or implement costly and unnecessary rebalances to bring investors into line.

- Rebalancing engine and corporate actions management ensures your client portfolios are always in line with their investment strategies.

- Ability to run direct equity models is a testament to the power of its portfolio administration capabilities.

- Corporate actions expertise across thousands of listed securities also means we can deliver accurate tax and performance reporting.

- You benefit from a competitive maximum trade charge.

Different structures, common benefits

All accounts, however you manage them, benefit from the following:

- A wide range of tax wrappers: GIAs, ISAs, SIPPs, QROPS, and Offshore Bonds.

- A broad range of asset types, including funds, exchange-traded products and cash. You can easily run portfolios which mix asset types.

- Ability to create and edit advisory templates for bespoke strategies.

- Access to a large range of DFMs covering active and passive strategies with both UK domestic and international focus.

- UK domestic and an international service for clients across three currencies; GBP, USD and EUR.

- IRS-compliant managed portfolios for US taxpayers provided by specialist discretionary managers.

- A world-class auto-rebalancing capability that removes the admin burden for both financial advice businesses and discretionary managers.

Upgrade today!

Start the upgrade now. Ask our expert team about the ways

Morningstar Wealth Platform can transform your business.