How to protect your capital for a prosperous retirement

Volatility is a blessing and a curse

Rising equity markets in recent years have given investors growth in their portfolios, but as we enter a period of higher volatility and lower economic growth these same investors can see their hard-earned profits evaporate. Periods of volatility can be great when investors are in the early stages of wealth building as these periods can present opportunities to buy assets at lower prices. However, in retirement, it can have the opposite effect. Investors may have to sell assets at a time when prices have fallen in order to fund their retirement, and depending on the timing, the effects can be catastrophic.

Know your timing

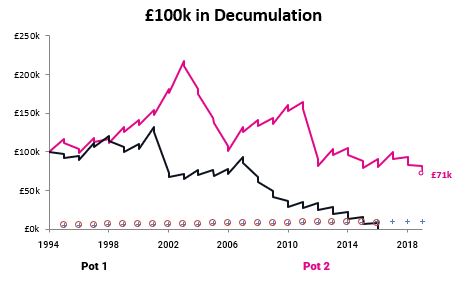

For example, let’s compare two portfolios of £100k which experience identical returns over a 20+ year period but in a different order. One suffers significant losses in the early years (black line) with the other (pink line) seeing those same losses in later years.

If both pots are in the wealth accumulation period, they will end up at the same point. If they are taking income in retirement, however, the story is very different. If £5k is withdrawn each year increasing by 3% to keep pace with inflation, the pot that incurred the losses in the early years will run out of capital by year 21. At the same point in time the second pot still has a value in excess of £80k. This is purely down to the effects of pound cost averaging and the fact that the first pot did not have enough time to recoup losses before future income payments were due, compounding the issue. This highlights the destructive power of sequence of return risk and can make review meetings difficult at the very time when the ability of clients in drawdown to generate additional income is at its lowest.

Protect your pot

Whilst diversification can help to dampen the impact of market fluctuations it doesn’t always work and other strategies are required to ensure capital protection is the priority even when there is still a need for asset growth.

The Smartfund 80% Protected range does just that, and with a minimum protection level of 80% at any time, gives investors the peace of mind they need to invest into equities for long-term growth knowing that sequence of return risk can be minimised.

For further information please visit smartfundsrange.com or smart-im.co.uk

Upgrade today!

Start the upgrade now. Ask our expert team about the ways

Morningstar Wealth Platform can transform your business.